irs child tax credit tool

The childs age must be under 6 or 17 and. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

Expanded Child Tax Credit Senator Bernie Sanders

The payments will be up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 through 17.

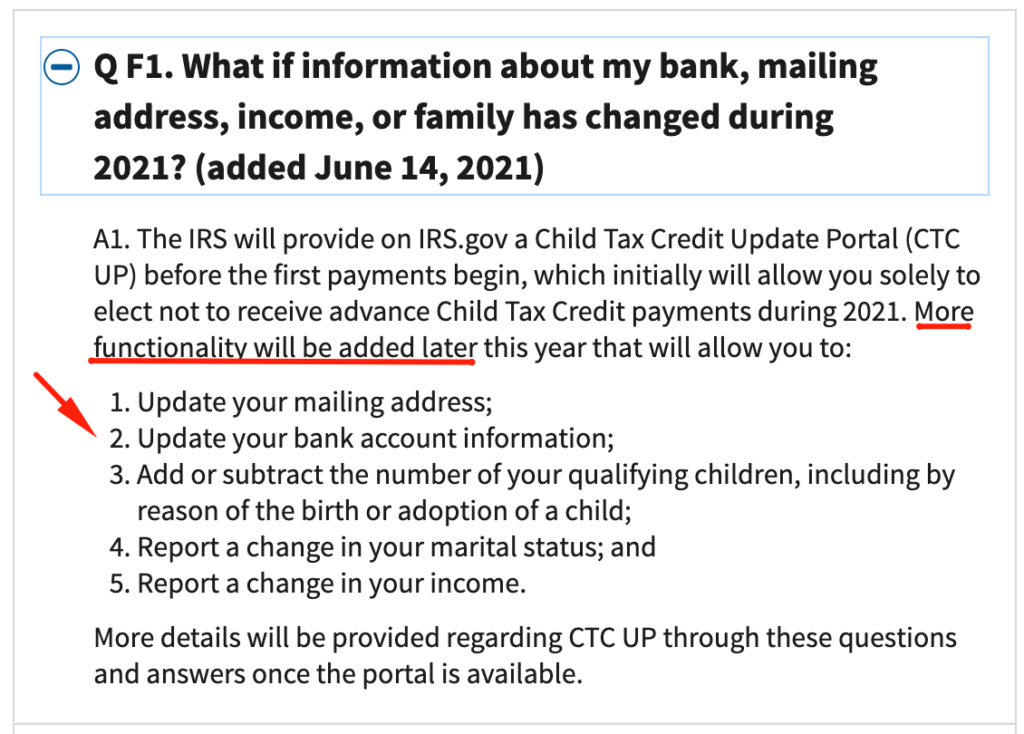

. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. The American Rescue plan increased the maximum Child Tax. But it doesnt work on mobile devices which advocacy.

As a part of the Act the IRS will pay eligible taxpayers half of their estimated 2021 Child Tax Credit in advance monthly payments beginning in July 2021. This is up from the existing credit of up to 2000 per child under. No Work By Families.

Skip to the content. Child Tax Credit Check Dates. Eligible families who already filed or plan.

WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility. IRS unveils online tool to help low-income families register for monthly Child Tax Credit payments No action needed by most families. The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July.

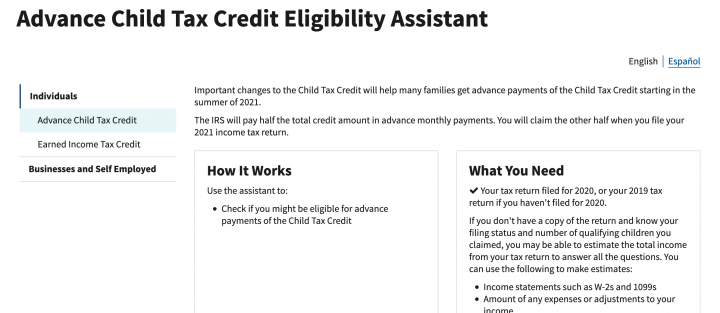

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The first tool that all parents should take time to look at is the Child Tax Credit Eligibility Assistant which is available exclusively on IRSgov. 1 day agoFor tax year 2022 the Child and Dependent Care Credit adjusts back to the pre-2021 provision and changes back to.

IR-2021-150 July 12 2021. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. You can use your username and password for.

Up to 35 of 3000 1050 of child care expenses for a. The Internal Revenue Service IRS also launched two online tools in recent months. Similar to certain other credits with an advance payment option taxpayers who receive.

For 2021 eligible families can claim up to 3600 per qualifying child under age 6 and 3000 per qualifying child between 6 and 17 with the expanded Child Tax Credit. IRS Child Tax Credit Non-filer Sign-up Tool Helps you report qualifying children born before 2021. IRS New Tool To Register For Monthly Child Tax Credit.

Who should use the. The IRS has launched an online tool to help low-income families register for monthly child tax credit payments. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify.

Often these are people and families who get practically zero pay including those encountering homelessness and other groups. It offers a free and easy way for eligible people who dont normally have to file taxes to provide the IRS the basic information needed name address and Social Security. It allows parents to answer a.

The Child Tax Credit Eligibility Assistant and the Child Tax Credit Update Portal. The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18. IRS Resources and Guidance Includes e-posters in other languages user.

This new tool is accessible just on IRSgov.

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Irs Portal Live Child Tax Credit Non Filer Sign Up Tool Youtube

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit Update 2021 Steps To Take If You Don T Receive The Correct 3 600 Payment The Us Sun

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Irs Launches New Tool To Get Child Tax Credit Payments To Non Filers

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Are You Eligible For Monthly Child Tax Credit Payments Check Irs Eligibility Tool Al Com

Irs Releases Online Tools Ahead Of Child Tax Credit Payments Eder Casella Co Certified Public Accountants

Irs Child Tax Credit Scam You Don T Need To Text Anyone

Advance Child Tax Credit And Redistricting Commission Town Of Berwyn Heights Md

Irs Deadline To Change Your Child Tax Credit Information Wfmynews2 Com

Tas Tax Tips Does The Irs Have Your Information On File If Not See If You Should Use The Child Tax Credit Non Filer Sign Up Tool Taxpayer Advocate Service

Child Tax Credit Irs Creates Nonfiler Sign Up Tool

Irs 2 New Online Tools Available To Help Manage Child Tax Credit King5 Com

Fourth Stimulus Check News Summary For Friday 9 July As Usa

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Irs Tool Offers Low Income Families A Tool To Get Child Tax Credit And Stimulus Checks Cbs News